Intro: why would you put your house in a trust?

Trusts let trustees hold assets for beneficiaries. House placement reasons. Not only the wealthiest gain from trusts. For your heirs, consider putting up money or property.

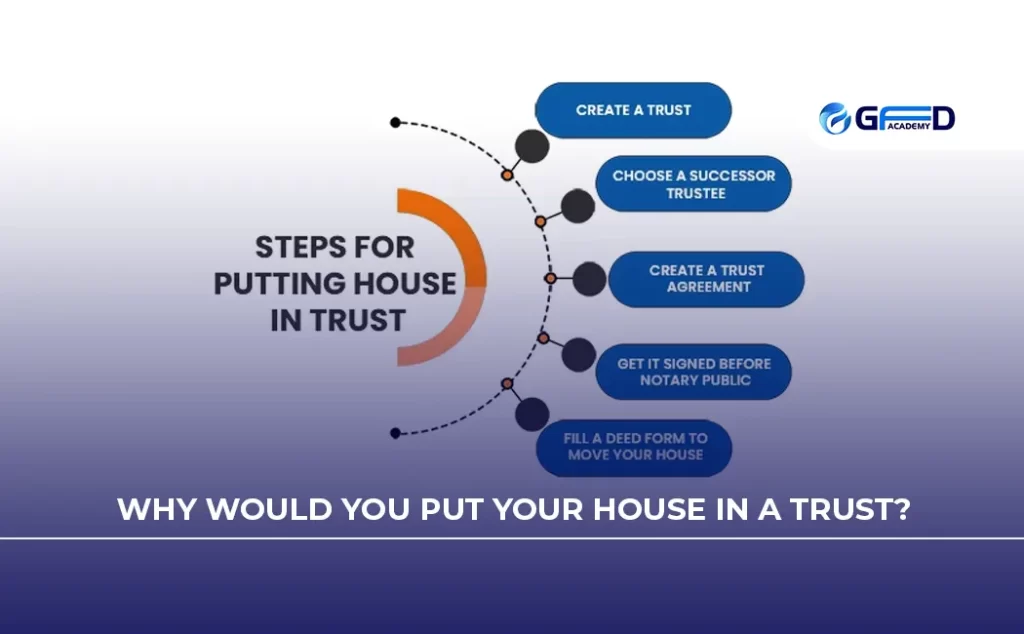

Create a trust to distribute assets to beneficiaries when and how you choose. You then choose a trustee—you, a relative, or a third party. However, trust creation is multifaceted. We cannot stress enough the need of hiring tax and trust specialists. For now, here are some reasons and ways to trust your home.

What is a trust sale?

A public auction for property held within a trust is known as a trust sale. Typically, the trustee sets a set of bid requirements, and the highest bidder who meets these requirements can purchase the house.

If a house is not in a trust, the court will likely hold a probate sale, which is comparable to a trust sale. The court will often evaluate every offer, which is the primary distinction. State-by-state variations exist in this process, but overall it takes a lot longer than a trust sale, which postpones beneficiaries’ receipt of their share of the estate value.

How would you place your home in trust?

If you’re considering placing assets in a trust, you may be considering the advantages and disadvantages of doing so. The purpose of this book is to help you better understand the differences between drafting a will and establishing a trust, particularly about your possessions. However, if you already have a will, do you need a trust? Let’s begin by figuring out why having both is beneficial. I have a will already. Do I also require a trust?

Can you sell a house in a trust?

How you set up your trust determines how you sell a home while you’re living. In a revocable trust, you can buy and sell. However, gains are subject to estate and capital gains taxes. Because you gave your trustee the authority of an irrevocable trust, they must sell the residence for you.

A trust beneficiary selling a home follows the same steps. The trust trustee sells the home. If the trust language doesn’t prohibit it, the trustee can transfer the residence to you, and you can sell it.

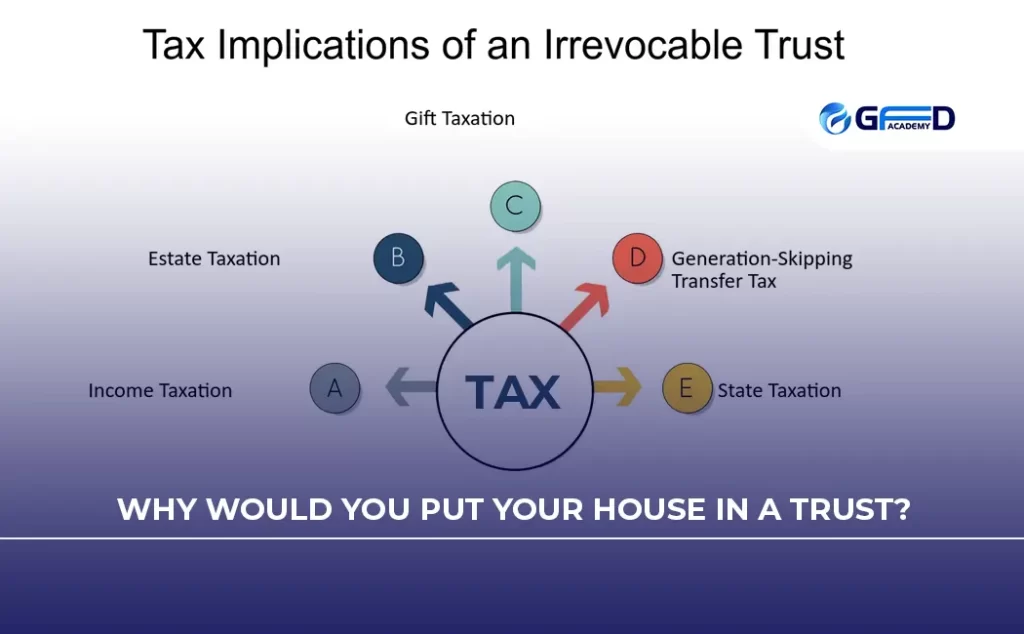

Trust sales: tax implications?

The type of trust and whether the creator (you!) is alive determine tax effects. It’s crucial to consult a trustworthy counselor while choosing a trust, and for your family to do so after you die. If you sell your house in a revocable trust, you can sell as you like and pay capital gains tax on your personal tax return. Your $250,000 federal capital gains exclusion ($500,000 if married) may help.

Since you transferred complete ownership of the home to an irrevocable trust and sold it through a trust sale before or after your death, you would not report gains on your tax return. Your death value ramps up the cost basis, making capital gains unlikely. Should the trust fail to sell the residence promptly and realize gains, it will have to pay capital gains tax on the generated revenues.

Your beneficiary would be individually liable for capital gains tax if they sold the home after your death, using the property’s cost basis. Since the cost basis is what you paid for the home when you bought it, selling before your death would certainly result in substantially higher taxes.

Can mortgaged homeowners put their properties in trust?

It’s customary to put a mortgaged house under a revocable trust. However, you must continue paying your mortgage. Certain property transfers trigger a “due on sale” condition that allows your lender to demand full payment immediately. Thankfully, the 1980s banned this practice for trust transfers. You can do so.

why would you put your house in a trust: A living trust?

Living or revocable trusts provide you with full legal authority over your assets until death. You can change or remove it at any moment. Flexibility comes without protection from creditors, who may claim your assets after you die. After you die, your estate will pay estate taxes.

An irrevocable trust gives the trustee legal ownership of everything in it. Once finalized, you cannot amend, add to, or disband the trust. Because the property is no longer yours and is no longer part of your estate, it will save you money on taxes and protect the home from creditors after your death.

How should you handle trust?

Putting your house in trust involves several subtleties and situation-specific concerns. To ensure your title and homeowner’s insurance are valid, verify with them. Make sure your county won’t evaluate property taxes if the home isn’t your principal residence.

You should also reassess your plan every few years as laws and finances change. Work with a great team, including an estate attorney, financial advisor, and trusted real estate agent, because every case is diverse and complicated. They can assure seamless operations now and after you die. Your family and beneficiaries will likely collaborate on estate matters and home sales after your death.

Clever Partner Agents help sellers save on commissions while guiding you or your beneficiaries. Clever partner agents are elite Keller Williams or Century 21 agents who know their local markets. Partners offer the same comprehensive service as other agents when selling your home, but they work for 1.5%. This keeps more money in your trust and loved ones’ hands.

What makes a will different from a trust?

A common misconception is that one does not require a trust if they have a will. This isn’t always the case, though. A trust and a will are both legal agreements that specify your wishes for your possessions when you die away, but there are some significant distinctions after that. The court system will oversee the distribution of your assets during a legal process known as probate if you have a will.

This procedure can be costly, lengthy, and often takes up to a year to complete. Your loved ones will also frequently have to attend many court hearings, which means they will have to pay for this legal procedure with both money and time. A trust can help prevent all of this.

A trust establishes the procedures for distributing assets without the need for court intervention.

This implies that you can complete distributions in a matter of weeks, as opposed to several months or years. You will pay an attorney in advance to prepare the trust document, saving your loved ones from having to deal with a bill for legal expenses to get through the probate procedure. The privacy of trusts is the last advantage to take into account if you already have a will but still want to choose one.

Anyone may see who received what and how much in a will. However, confidentiality within a trust renders this data inaccessible. After we’ve briefly discussed some of the advantages, you might be wondering how to determine whether you need trust.

When Should You Consider Obtaining a Trust?

Having a trust and a will have their place and time. For lesser assets, like the antique dining room furniture your grandmother once had, a will works best. However, if you have more expensive assets, such as a house, vacation home, or investment portfolio, a trust rather than a will would be more appropriate for you. Let’s talk about the reasons you might want to transfer your assets into a trust rather than a will.

Why would you put your house in a trust?

When you die away, a trust will relieve your loved ones from the probate procedure. Your spouse or children will not have to pay the high probate expenses, which can amount to up to 3% of the value of your asset, if you place your home in a trust. Furthermore, if you leave numerous properties to your family in a will, they will have to deal with the probate regulations and fee structures of each state, which is the situation if you own a vacation house.

This implies that they will also have to spend time traveling to and from court dates as well as locate counsel in each state. However, if you establish a trust, an estate planning conference with an attorney will handle all these matters before your death. Additionally, they won’t need to spend time or money going to court to get what you left them when the time comes for you to pass away.

Remember that there are no restrictions on how you may increase your trust. You should include any expensive assets you possess, such as:

- Patents and copyrights

- Stocks and bonds

- Art or antiques

- Precious metals

- Collectibles (cars, coins, stamps, etc.)

However, there are two sorts you’ll need to choose from before setting up your own trust.

The differences between the two types of trusts are significant.

There are two kinds of trusts available to you:

- Living or revocable trust

- Unchangeable trust

An irrevocable trust is unchangeable, as the name implies.

Therefore, should you decide to change your mind, you won’t be able to remove anything or even dissolve anything. An irrevocable trust has the advantage of potentially saving you money on taxes because its value won’t be deducted from your estate after you pass away. It is therefore a wise long-term plan. On the other side, you can add and remove assets as needed if you select a revocable trust. If your circumstances change, you can also fully dissolve the trust.

Read More: Best Walkie Talkies For Cruise Ships? Everything You Need To Know

Up until the moment of your death, you will have exclusive control over your trust. Should you become incapacitated, your spouse or another designated co-trustee may assume management of the trust in your place. However, there are two drawbacks to revocable, or living, trusts. Firstly, your asset remains part of your taxable estate at the time of your death.

Furthermore, a living trust won’t keep creditors from seizing your assets. You may begin the process of selecting the option that would be best for you now that you have a better understanding of the reasons behind putting your home or any other important asset in a trust.

Should You Put Your House in a Trust?

Even though you have gained more knowledge about placing assets in trust, you might not have enough knowledge at this time to make a decision. You should thus speak with a specialist who has years of expertise managing trusts, wills, and financial planning.

They can help you decide between an irrevocable and revocable trust based on your objectives, assets, and any current estate planning or wills. Having completed your study, you’ll be ready to plan your wishes in a meaningful talk. why would you put your house in a trust?